The Workers Compensation Board of Manitoba (WCB) maintains a reserve fund to protect employers and workers while ensuring a stable workers compensation system. This reserve fund is currently higher than the target set in our funding policy. As a result, in May of 2021, we are distributing surplus funds to employers, whose premiums fund the workers compensation system.

The surplus is due to a number of factors: Why is there a surplus?

Employers who fulfilled their payroll reporting responsibilities for 2020 and owed a WCB premium for 2020 are eligible to receive a share of the surplus distribution.Who is eligible to receive the surplus?

Employers who did not report their payroll for 2020 or who did not owe WCB premiums for 2020 are not eligible. However, if an employer subsequently submits their 2020 payroll the WCB will process the surplus distribution which will be applied to their account.Who will not receive the surplus?

The WCB is returning $71 million in surplus funds. Each eligible employer will receive a credit to their account of 40 per cent of their 2020 actual premium.How much will each employer receive?

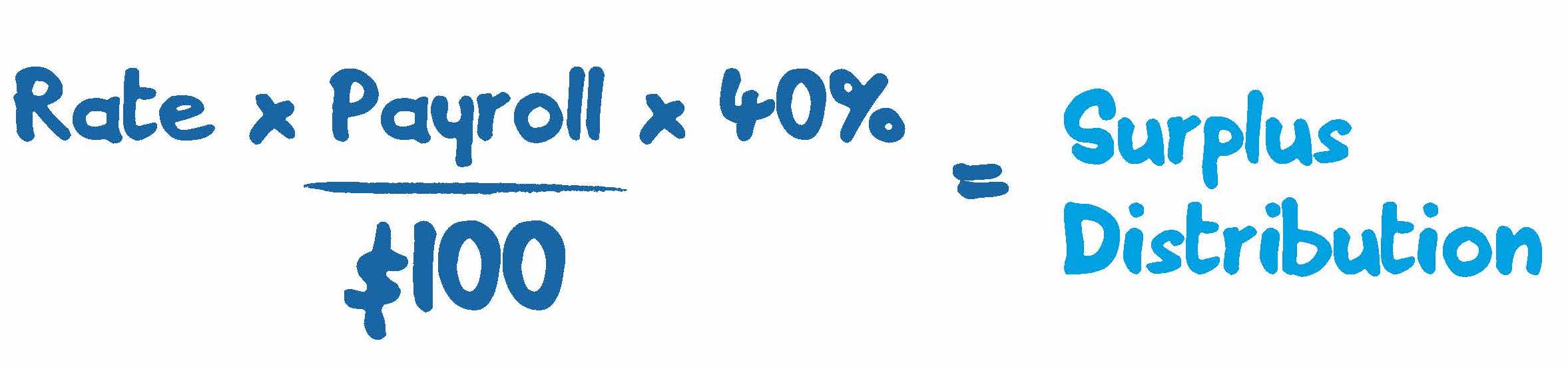

The 40 per cent surplus distribution will be calculated against an employer’s 2020 premium; the premium is determined by multiplying the WCB rate by every $100 of payroll. Employers aligned to an Industry-Based Safety Program do not have their safety levies included in the 2020 premium used for the surplus distribution calculation. What method will be used to determine how much each employer gets?

Eligible employers will receive a credit to their account which has been applied against their 2021 premium. These credits are reflected in the May WCB Account Statements.When is the surplus being distributed?

Future surplus distributions will depend on the WCB’s funded position. The Board of Directors reviews the WCB’s funded position annually and determines if a surplus distribution is warranted.How often will there be a surplus distribution?

Yes, the surplus distribution is taxable since it is a return of a 2021 tax deductible expense.Is the surplus distribution taxable?

Download the Surplus Distribution FAQ

For more information about surplus distribution contact Assessment Services:

Winnipeg: 204-954-4505

Within Canada and the US toll-free: 1-855-954-4321, ext. 4505

Fax: 204-954-4900

Within Canada toll free fax: 1-866-245-0796

Email: assessmentservices@wcb.mb.ca