Workers’ compensation coverage protects workers and employers from the impacts of workplace injuries and illnesses. The funds needed to cover the cost of WCB benefits and services are collected from registered employers in the form of premiums. Like other insurance premiums, WCB premiums are based on a combination of the risk of incurring claims costs and the value of what is insured.

We define risk as the potential cost of future workplace injuries (based on the costs of past claims) and determine value using the assessable payroll of your workforce. Your risk is expressed in your WCB rate, which is multiplied by every $100 of your payroll to determine your premium.

We assess your risk and determine your rate through a mechanism we call the rate model. The rate model is how we make sure every employer pays their fair share of costs. Employers share the cost of the workers compensation system, while also paying higher or lower rates based on their own claims experience and the experience of the industry classification they share with other employers.

Below are the factors that go into measuring risk and calculating WCB rates.

Average Rate

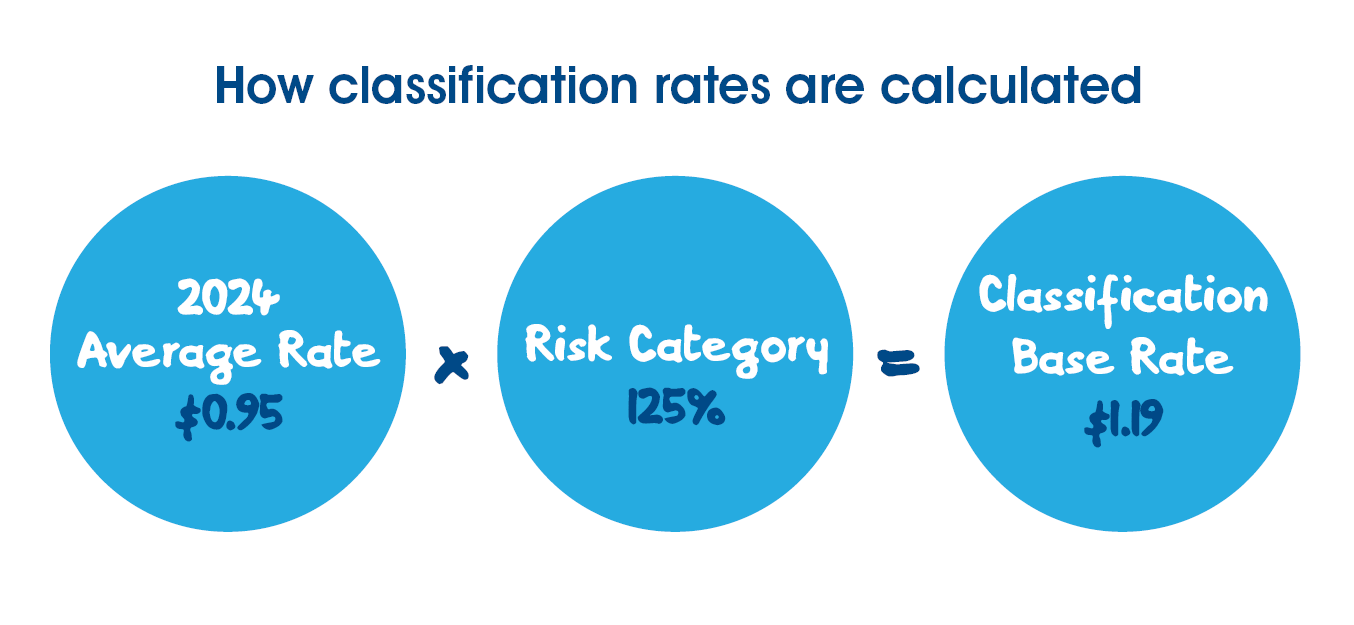

The average assessment rate, or average rate, is what you would pay if every employer paid the same WCB rate. The total expected costs for the coming year (claims costs in the current year, potential future costs of current claims, and administrative costs) are divided among all covered employers in Manitoba. The average rate is a baseline – we use it to set rates for each classification group.

When the total cost of injuries for all covered employers in Manitoba decreases, the average rate decreases, and this decreases the baseline rate for all employers. If the average rate increases, the baseline rate for all employers increases.

Manitoba employers have maintained one of the lowest average rates in Canada at an all-time low of $0.95.

Classification Risk and Rates

There are approximately 175 industry classifications in Manitoba. When you register with the WCB, your business is assigned to an industry classification based on the overall kind of work you do.

An industry classification is made up of a group of employers who operate in a similar industry with a similar level of risk. Each industry classification is assigned a risk category that describes their level of risk (cost of injuries) compared to the system average.

Each year, we monitor industry classification experience rates to ensure that employers are placed in the proper risk category. There are eighteen risk categories. As your industry's experience evolves, it may move a risk category to shift towards the experience reflected by costs and experience of the industry classification. Classifications and their risk categories are based on four years of historical data that tell us how likely employers are – in comparison to the average of all employers – to have claims and claims-related costs. Risk categories are expressed as a percentage of that likelihood in relation to the base rate.

For example, an industry classification that has injury costs that are only 25 per cent of the average of all employers is put into the 25 per cent risk category. A classification in the 200 per cent risk category is expected to have twice the claims costs as the average of all employers. When an employer registers with the WCB, they are assigned the classification base rate of their risk category. Over time, their rate will be adjusted up or down within an established range of rates for that risk category depending on their actual claims costs.

Employer Size and Rate Range

Within each classification, employers pay more or less than the classification base rate based on their past claims costs. The range – how much more or less than the classification base rate it is possible to pay – is based on employer size. Small and medium employers have a narrower rate range than large employers. Small and medium employers tend to have bigger changes in claims costs from year to year than larger employers (for instance, a small or medium employer could have several years claims-free followed by a year with a single high-cost claim with costs that last for several years). A narrower rate range protects small and medium employers against sharp changes in their rate caused by sharp changes in their claims costs.

Employers are grouped according to payroll size for the purpose of rate calculation:

| Small | Medium | Large | |

|---|---|---|---|

| Payroll Size | Up to $750,000 | $750,000 - $7.5 million | Over $7.5 million |

| Risk Category Range | 10% below to 30% above category range | 20% below to 60% above category range | 40% below to 120% above category range |

Your business size affects your rate in two ways:

- the range of rates you can pay above or below your industry classification’s base rate

- how your business’s claims costs and your industry’s claims costs are blended to calculate your rate.

An employers' claims cost experience carries different weight based on their size. A large employer's individual costs experience has a greater impact on the premiums they pay, but for medium employers, the industry experience has a greater impact on what you pay.

Rates for medium employers use a smaller rate range and greater percentage of the industry’s claim costs. This helps protect medium employers against volatile changes in their rate caused by sharp changes in their claims costs.

Experience Factor

An employers' experience carries different weight based on their size. A large employer's individual costs have a greater impact on the premiums they pay, whereas for small and medium employers, the industry classification they are in has a greater impact on what they pay.

| Small Employers | Medium Employers | Large Employers | |

|---|---|---|---|

| The percentage of your individual experience used to calculate your rate | 20% | 30-40% | 40-100% |

| The percentage of your classification's experience used to calculate your rate | 80% | 60-70% | 0-60% |

Generally, an employer who invests in safety and prevention and makes every effort to return injured workers back to health and safe and suitable work will have lower claim costs and pay a lower rate.

View the listing of Classifications and their Risk Categories

The Impact of Claims Costs – Your Risk and Rate

The cost of injuries at your workplace directly affects your risk. Those who have more costs typically pay a higher premium.

As part of the rate calculation, we compare your injury costs to an average employer of similar size and risk. If your rate has gone up, it means that either your costs are higher, or your industry classification’s performance has declined. If your costs are lower, you'll likely see a decrease in what you pay. When we set rates, we use the claims costs from the last three calendar years of claims.

For 2024, the calculation of rates considers costs paid from January 1, 2020 to December 31, 2022 on claims that occurred during the same time frame.

If you're a new employer in Manitoba, you don't have any previous claims cost experience with the WCB to establish your rate. Your premium will be determined by a new employer rate assigned to your industry classification.

Industry-Based Safety Programs

Manitoba has many industry-based safety programs in partnership with SAFE Work Manitoba. They are designed to support employers in establishing an effective safety and health program, to assist in identifying work place hazards and to keep workers safe on the job.

Through these safety programs, employers can work together to reduce their individual and classification-wide injuries and resulting costs.

These programs are funded in part by all employers within the corresponding levied classification codes. The WCB collects and distributes these program fees (called a safety levy) through employers' premiums as a percentage of their rate.

Employers who are represented by an industry-based safety program and who embrace workplace injury prevention can reduce the number and cost of injuries in their workplace and, as a result, benefit from lower rates.

Learn more about industry-based safety programs

Rate Increase/Decrease Limits

We have limits built into the rate model to protect you from too much fluctuation in any given year. Your WCB rate cannot move up or down more than 15 per cent from year to year. Also, your rate can't go below the lower or above the upper end of the category range.

Learn more about risk category changes

Balancing Adjustment

Because there are many factors involved when we calculate premiums, it can be difficult to ensure revenue raised by premiums matches the revenue we require to cover workplace injuries and illnesses. Once rates have been determined, we apply a balancing adjustment evenly to all employers to ensure we are able to break even. For 2024 rates, the balancing adjustment is 0.99%.

More Information about Premiums and Rates

Your Rate Notification Can Tell You a Lot

Did Your Rate Change in 2024? This May Be Why

Industry-Based Safety Programs and How They Help Your Business